Navigating the tricky aspects of investing can seem overwhelming, especially for those just starting out. But with the rise of digital financial advisors, making smart investments has become more convenient than ever before. Robo-advisors harness algorithms and complex technology to manage your portfolio based on your financial objectives.

- Often, you'll begin by answering a series of queries about your investment preferences.

- Based on your responses, the robo-advisor will construct a well-rounded portfolio of assets

- Moreover, many robo-advisors offer tools such as retirement planning to help you maximize your returns over time.

Whether you're seeking long-term growth, saving for a specific goal, or simply want a effortless way to invest, robo-advisors can be a effective tool.

Demystifying Robo-Advisors: Your Investing Companion

In today's dynamic financial landscape, navigating the complexities of investing can feel overwhelming. Thankfully, the emergence of robo-advisors presents a user-friendly solution for individuals seeking to Grow their wealth. These innovative platforms leverage cutting-edge algorithms and machine learning to Automate the investment process, making it accessible to a wider range of investors.

- Robo-advisors offer a Cost-effective approach to investing, typically charging lower fees compared to Standard financial advisors.

- Robo-advisors themselves provide Tailored investment portfolios Based on your individual Risk tolerance.

- Additionally, robo-advisors often Offer a range of Learning tools to Educate investors with the knowledge needed to make informed decisions.

Therefore, robo-advisors have become an increasingly Trending choice for individuals looking to Begin their investment journey or Optimize their existing portfolios.

Digital Wealth Managers: Simple, Smart Investing for Everyone

Investing commonly has been a complex process reserved for those with extensive financial knowledge and resources. However, the rise of robo-advisors is revolutionizing the investment landscape, making it accessible to everyone. These automated platforms employ algorithms and sophisticated financial models to create tailored investment portfolios based on your risk tolerance.

Robo-advisors offer a simplistic approach to investing, removing the need for hands-on management. They regularly rebalance your portfolio to match with your targets, ensuring that your investments are always working towards your financial goals.

By means of their low fees and intuitive interfaces, robo-advisors have equalized access to wealth management, empowering individuals to steer their own financial futures. Whether you are a beginner or an experienced investor, robo-advisors provide a reliable and effective solution for achieving your financial goals.

Embark on Robo-Advisors: A Step-by-Step Guide

Stepping into the world of automated investing can feel overwhelming, but it doesn't have to be. Robo-advisors are designed to make investing simple and accessible, offering a user-friendly platform to build your portfolio without needing extensive financial knowledge. To start your journey with a robo-advisor, follow these easy steps:

- Research different robo-advisors: Compare their fees, investment strategies, and features to find the best fit for your needs and risk tolerance.

- Create an account: You'll need to provide personal information like your name, address, and investment objectives.

- Deposit your account: Link your bank account or credit card to transfer funds into your new robo-advisor account.

- Track your portfolio: Regularly check the performance of your investments and make adjustments as appropriate. Remember, investing is a long-term game.

By following these steps, you can easily get started with a robo-advisor and begin building a secure financial future.

Using Robo-Advisors to Build Your Portfolio: Strategies and Tips

Navigating the investment landscape can be daunting, especially for individuals starting to their investing journey. This is where robo-advisors come in, offering an automated approach to portfolio construction and management. These digital platforms utilize algorithms and sophisticated technology to create tailored investment portfolios based on your financial goals, risk tolerance, and time horizon. investing with robo-advisors in 2024

- To maximize the benefits of robo-advisors, it's essential to carefully research different platforms and evaluate their fees, investment strategies, and customer service offerings.

- Moreover, clearly define your goals and risk appetite before choosing a robo-advisor.

- Regularly track your portfolio performance and rebalance it as needed to align with your shifting circumstances.

By leveraging robo-advisors, you can simplify the investment process and work towards achieving your financial aspirations.

Explore the world of Robo-Advisor Investing

Are you eager to begin your investing journey but feel overwhelmed? Robo-advisors offer a streamlined solution, allowing even beginners to construct a diversified portfolio with no effort. These digital platforms employ sophisticated algorithms to analyze your risk tolerance and financial goals, then strategically distribute your funds across a range of assets like mutual funds.

- A key advantage of robo-advisors is their budget-friendly nature, with many charging significantly less than traditional financial advisors.

- Moreover, robo-advisors provide accessible access to your portfolio, allowing you to track your investments at any time.

- Ultimately, robo-advisors offer a efficient way to get started with investing and possibly help you achieve your financial goals over the long term.

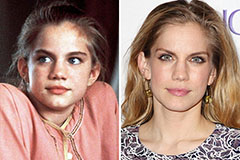

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!